When to Use Credit Memos in QuickBooks Online

TLDR: Credit memos are for when you want to decrease the amount owed on an invoice but you have not received any money.

Understanding accounts receivable (A/R) is crucial in accounting, as it refers to the outstanding invoices owed to your business. To maintain accurate records of A/R, it's essential to make the appropriate entries. Credit memos are a tool in your accounting toolbelt to keep your A/R straight

Key Concepts

Accounts receivable represents assets (what your business owns), similar to a loan receivable. When an invoice is created, it increases the accounts receivable (A/R). Receiving payment for an invoice decreases A/R. In accounting terms, creating an invoice results in a debit to A/R, while receiving a payment leads to a credit to A/R. Debits increase assets, while credits decrease assets.

Debits and credits can be thought of as follows: credits represent the source of funds, while debits indicate where the funds go. In accounting, every transaction must have equal debits and credits.

If an invoice debits A/R, it usually credits "Sales" or "Revenue." The diagram below illustrates how funds flow from sales to accounts receivable:

To better understand this concept, consider a cash transaction. In such a transaction, money from sales goes to the bank account, increasing both sales and the bank account balance. A similar process occurs with invoices, where accounts receivable increase instead of the bank account balance.

When to Use a Credit Memo

Now that you understand the key concepts, let's discuss when to use credit memos. Credit memos perform the opposite function of an invoice; they decrease both accounts receivable and sales (in most cases) without receiving any money.

Here are some common situations where you may need to use a credit memo:

- Returned goods or services: If a customer returns a product or cancels a service that has been invoiced, a credit memo can be issued to adjust their balance accordingly.

- Pricing adjustments: In cases where a pricing error has occurred or a special discount needs to be applied after the invoice has been issued, a credit memo can correct the invoice balance.

- Rebates or promotional offers: If your business offers rebates or promotions, issuing a credit memo can help apply these benefits to a customer's existing invoice.

Credit Memos vs. Payments

It's important to distinguish between credit memos and payments. Sometimes, business owners mistakenly create payments when they should have created a credit memo. This can happen if a customer performs a service for the owner, leading them to reduce the invoice amount. Remember this rule: if you did not receive money, it is not a payment. Payments always involve receiving money, while credit memos decrease the invoice amount without receiving any additional funds.

Creating a Credit Memo in QuickBooks

Follow these steps to create a credit memo in QuickBooks Online:

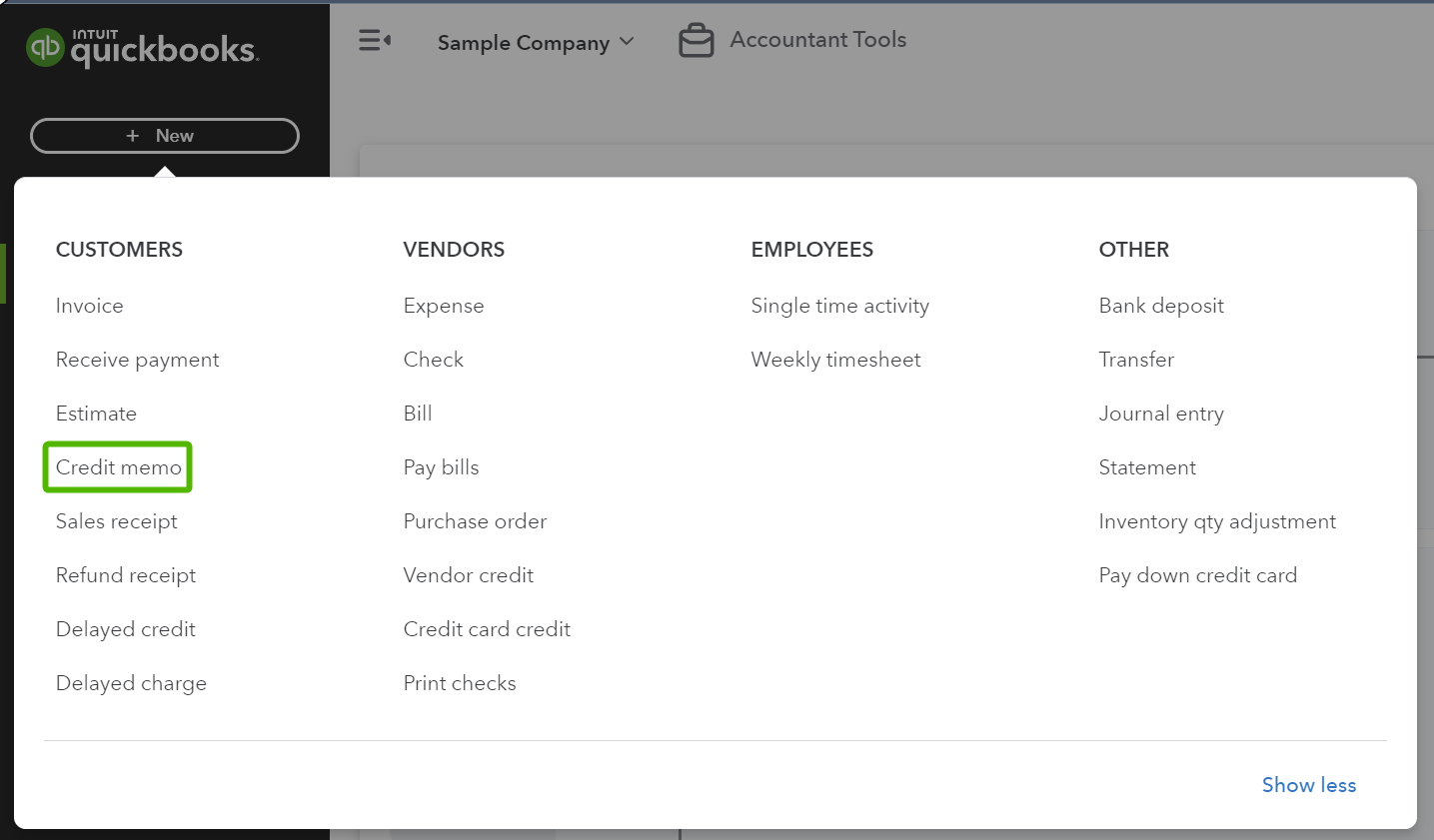

Click the + New button on the top left corner of the screen.

In the Customers column, select Credit Memo.

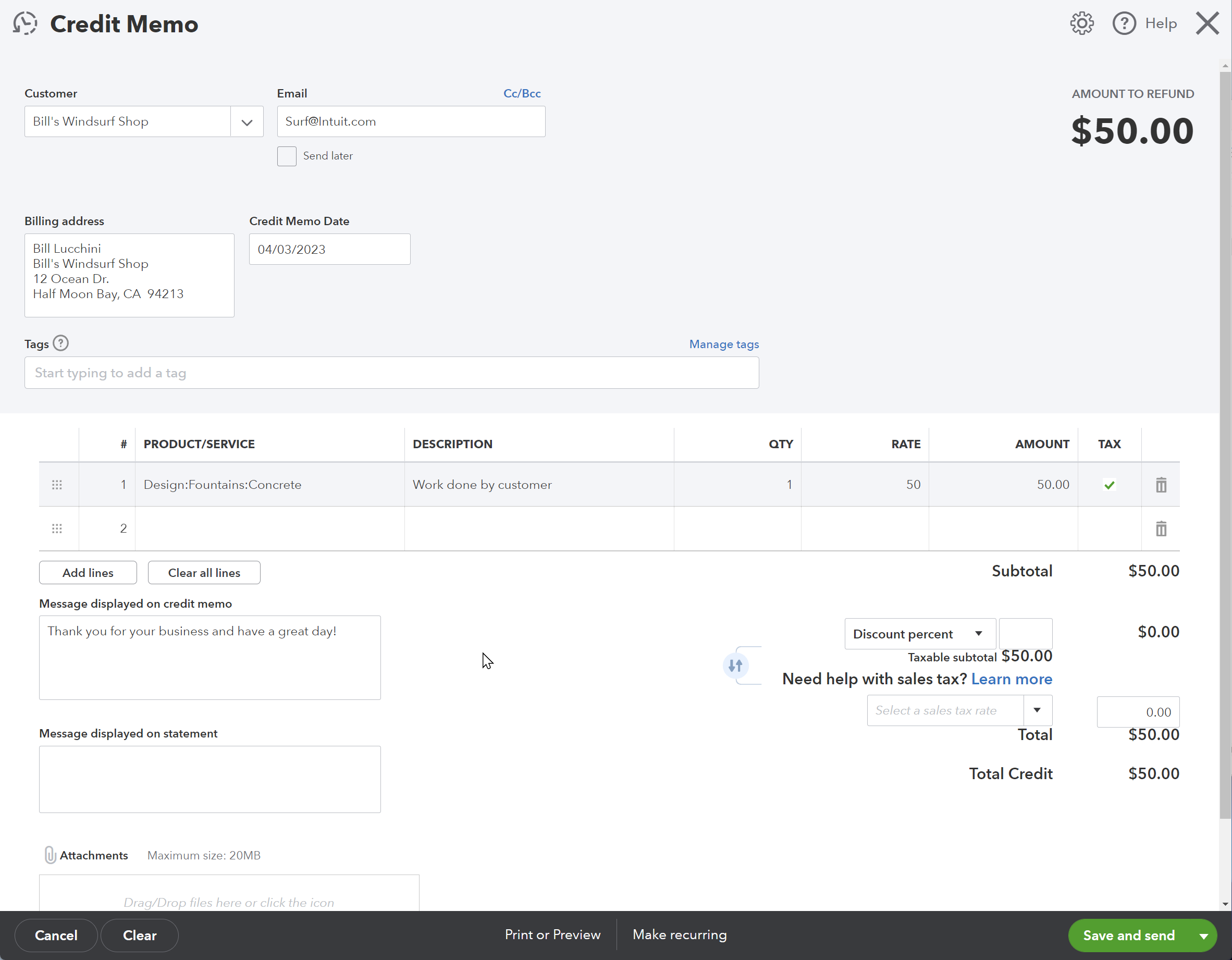

On the credit memo page, choose the customer you're crediting and the product or service you're refunding. In most cases, the product or service selected should match the one on the invoice.

Once all the information is correct, save the credit memo.

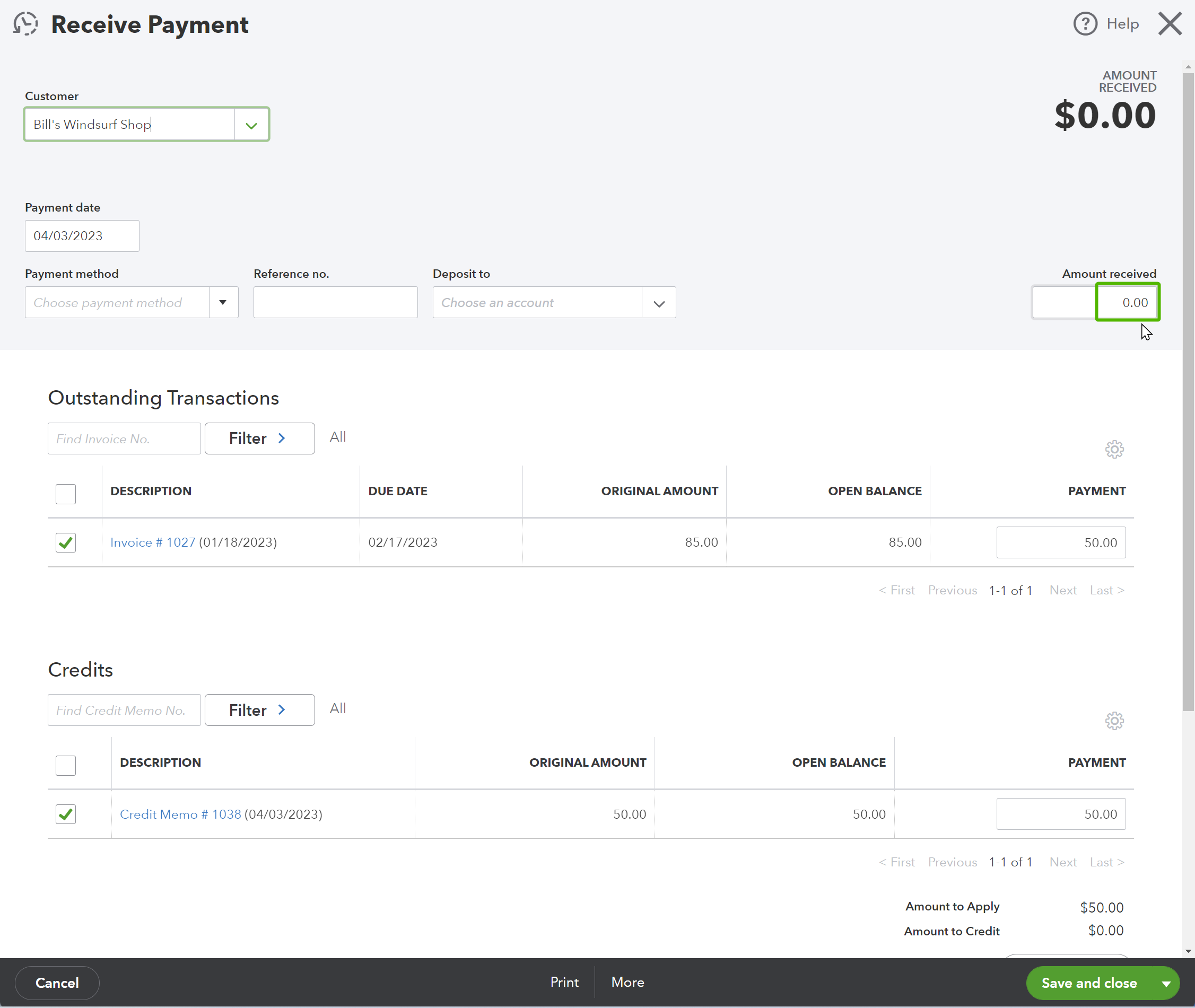

QuickBooks Online will automatically create a zero-dollar payment to apply the credit memo to the invoice. This payment applies the credit memo to the invoice without receiving any additional funds. As shown in the image below, the amount received is zero, but the amount applied to the invoices is still fifty dollars.